“We have the best mousetrap as the market comes to us. Everyone else is running a 5,6,7-minute mile.”

“We can run a 4-minute mile.”

- Joe Thompson, COO

KITS Eyecare, a pure play e-commerce retailer of eyeglasses and contacts, has the potential to become a long-term compounder. KITS went public in 2021 at CAD $8.50/share, and trades at CAD $13/share today (up 60% YTD) on the back of five years of tremendous business progress and having reached a major inflection point in their business and growth trajectory. Furthermore, I don’t believe the market fully appreciates the company’s competitive position, best-in-class cost structure with significant operating leverage, and long runway for profitable growth. What I’m saying is that KITS is a great business. In addition, this investment has near zero exposure to punitive tariffs nor is there disruption risk via AI.

A few highlights:

Kits Eyecare is the fastest-growing optical company to achieve a $150 million revenue run rate, starting from scratch.

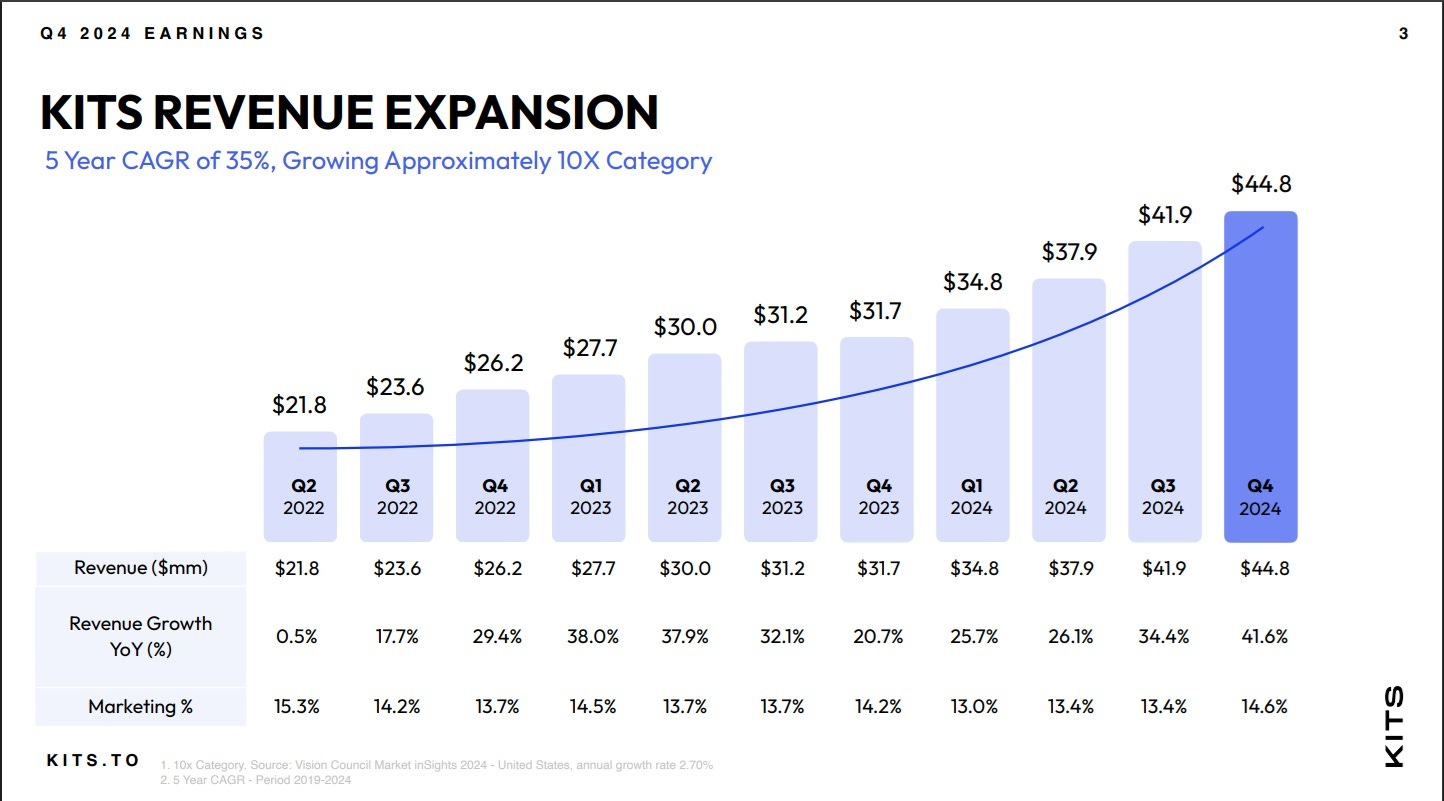

The company has experienced nine consecutive quarters of growth, with an average rate of +30%.

Kits Eyecare is entirely funded by cash flow and has a positive adjusted EBITDA.

With nearly 1 million active customers, the company boasts the highest retention rate in the industry

Repeat customers generate nearly 70% of the company's revenue.

Despite the apparent simplicity of the concept, the optical industry has been slow to evolve, opening the door for the continued transition to online purchasing

Overview

KITS is a vertically integrated manufacturer and e-commerce retailer of eyeglasses and contacts, along with sunglasses and accessories. The company does business primarily in the US and Canada, and is poised to become one of the leading online retailers of eyewear during the next 5-10 years. KITS was founded by Chairman and CEO Roger Hardy, who also founded Coastal Contacts, an early publicly traded pioneer of optical e-commerce. Coastal grew from less than $30mm in sales in 2004 to over $200mm by 2014, resulting in a sale to Essilor for $430mm, generating a 1,100% return for shareholders. Of note, I use the term manufacturer loosely, as KITS sources materials from third parties and assembles their frames and prescription lenses in house via their fully owned optical lab, but they assemble the product and handle the prescription.

Today, KITS looks eerily similar to Coastal at the time it was sold. Coastal was doing $200mm revenues in 2014, which KITS will surpass this year. Coastal grew the top line 24% for 10 years and during that time gross margins expanded from 18% to 42% as glasses became a larger part of the mix. GM expansion for Coastal took off significantly once they hit $150mm in revenues. It took Coastal 8 years to surpass 40% GMs, while KITS should get there in years 5-6 (mgmt's goal is 40% near term on the way to 45%). This is at least illustrative of the significant opportunity for KITS during the next 4-5 years.

An argument could be made that Roger Hardy sold too early. Once Essilor dismantled Coastal, Roger began thinking about how to build a better mousetrap. He started having coffee with some business partners including now COO Joe Thompson and former CFO/Board member Sabrina Liak at a shop near Kitsilano Beach in Vancouver, where the idea for KITS was born. The Kits Beach store on Yew Street is the company’s only brick and mortar location, also serving as a coffee shop. Roger, Joe and Sabrina founded KITS in 2018 with an initial equity investment and went public in 2021, raising CAD $55mm, the only capital raised to date.

I’d argue that today’s environment provides a much better opportunity for building an e-commerce eyewear company, with more consumer comfort purchasing eyecare online, and a cohort of current and future customers (millennials) to sell to ten years later. Globally, at least 2.2 billion people have near or distance vision impairment, with over 4 billion wearing glasses. In the United States, approximately 66% of adults use some form of vision correction.

Furthermore, the difference in customer experience between a well-run e-commerce business like KITS or Warby Parker and an optometrist or legacy brick and mortar player is night and day. A better customer experience – better selection, convenience, and lower cost – means tremendous customer captivity (those who need eyecare tend to need it for life) and significant repeat orders. As I’ll describe below, in just seven years, KITS management built a better mousetrap for e-commerce eyecare, lending itself to recurring revenue, a strong moat, a significant growth runway, and a strong focus on the customer. I believe KITS competitive advantages will widen over time.

Business

KITS mission is to make eyecare easy, and that’s what they’ve done. The company offers a wide selection of contacts and prescription eyewear with low prices and fast shipping, along with online vision tests and prescription renewals, enabling a superior value proposition for customers versus legacy retailers. This value proposition is made possible in part by KITS ability to take cost out of the value chain by owning their own automated optical labs and selling direct to consumer. Years of investment have enabled KITS to manufacture eyeglasses in-house (as opposed to the traditional model of outsourcing to a third party), made to order in as fast as 30 minutes, while controlling quality and cost, allowing KITS to eschew traditional markups for frames and lenses typically seen throughout the industry. Despite lens and frame quality in line with anything you find at your optometrist office or Warby Parker, KITS sells eyeglasses for 20% or less of the price of competing products, while remaining considerably more profitable than its e-commerce competitors.

Customers can purchase a pair of prescription glasses for as low as $28 and receive them within 1-3 business days, leading to high customer satisfaction and repeat visits. KITS convenient, scalable and limited inventory model has been perfected during the past 7 years, and exceeds all legacy players, who burden customers with long wait times, mandatory eye exams, 1–2-week shipping, and unnecessarily high prices, in some cases between $300-$1,000 dollars for a single pair.

COO Joe Thompson speaks to the value prop in more detail:

“We continue to be driven by the mission to make eye care easy. And for us, that means having a deep understanding of what it is that customers love about the KITS experience, making sure customers get that experience every time, ensuring that the experience will scale as we grow. At KITS, this means making it possible to find and buy a fabulous pair of prescription glasses or contact lenses in under 5 minutes. It means having access to almost any prescription lens and frame for under $50. And it means getting your order in 1 to 2 days and loving them on first sight.

There's magic here when we do this. We take an experience that has traditionally put all your shortcomings on display and has cost a lot of money and taken a lot of time, and we've made it simple. With consistent execution at this level, we believe we will continue to earn the trust of customers for life.”

So far, this model is working and demonstrating strong growth potential. From its founding in 2018 to today, KITS is the fastest growing eyecare company to reach $150mm in revenues, ever, and has rattled off 10 straight quarters of 25% growth and 6 straight quarters of 32% or higher growth, significantly outpacing the industry average. KITS is scaling their business, but this is an asset lite model (capex 1-2% of revenues) and on my estimate of normalized profit margins, returns on capital exceed 35%.

KITS is also showing improving unit economics in terms of customer growth, average order value, growth in eyeglass sales and gross/EBITDA margin expansion, while being nowhere near their customer acquisition ceiling, with just 1 million active customers today.

The importance of being vertically integrated can’t be overstated. KITS spent tens of millions of dollars automating their optical lab, a 70k square foot facility that is currently churning out 2,000 pairs of glasses per day. Capacity is up to 4,000 pairs per day, which would add significant gross profit dollars when fully reached. This vertically integrated model, controlling the entire process from design and manufacturing to sale, allows for low production costs and higher margins compared to traditional retailers, while insulating KITS from supply chain and price increase challenges seen across the industry. KITS has driven labor per pair of eyeglasses is down to the single digits (dollars). Removing costs from the value chain enables KITS to pass along cost savings to customers in the form of low prices. The average cost of Kits branded glasses is only $69 compared to the US average of $350, while contact lens purchasers save 30% on average.

Despite elevated investments for growth, KITS is profitable and cash flow positive, the only pure play e-commerce eyewear business to fit that description. KITS is incredibly difficult to compete against, not only because their products sell for 1/5th the price of competitors, but also because competitors COGS and operating costs per unit are higher than KITS average selling price. It would be impossible for a company like Warby Parker or EssilorLuxottica to dramatically reduce prices in line with KITS, creating a powerful competitive position.

Strategy

In the optical industry, the sale of eyeglasses and lenses specifically drives the majority of industry profits. Eyeglasses are complex pieces of technology that require advanced machinery and expertise to manufacture. For most brands, a lack of expertise in manufacturing requires outsourcing production to a concentrated group of suppliers, meaning manufacturers can charge significantly higher prices than their costs would suggest is necessary. EssilorLuxottica controls nearly 50% of the industry by owning many parts of the value chain, including retailers, e-commerce players and manufacturing in the form of optical labs. For decades, Essilor has typically been able to extract rent-seeking prices for eyeglasses, despite their low cost of production, given opaque industry pricing and control of the supply chain.

As a result, the historical price to value equation has been to the detriment of the consumer. The industry is ripe for disruption. Decades ago, with Coastal, KITS management saw an opportunity via a large gap in the market among younger consumers that were both comfortable shopping online for eyecare and would prefer a better consumer experience and more affordable price point, without skimping on quality. Warby Parker, founded in 2010, also saw this opportunity, but has since pivoted their model to brick and mortar, which I discuss briefly below.

KITS is a customer focused business. COO Joe Thompson came from Amazon, and helped integrate at KITS a customer focused, low-cost, everyday-low-price culture. As discussed throughout, management realized that if they delivered products and a customer experience far ahead of the traditional price to quality spectrum, customers would come back to the site repeatedly. Management also knew that selling eyeglasses first (Warby Parker’s strategy) is a difficult undertaking given the upfront cost of acquiring customers and the challenge of retaining them. Significant marketing spend is required before dollars start rolling in, which is why most e-commerce players have yet to find the formula for profitability, including Warby Parker who, despite raising hundreds of millions in venture capital, remains unprofitable.

KITS started selling contacts first. Despite the unattractive financial profile as a commoditized, lower-margin product, this was a great chess move, as contacts drive recurring purchases, meaning these early efforts resulted in customer stickiness and repeat business. In e-commerce eyecare, the CAC/LTV equation is incredibly important. KITS customers are spending >100% of their initial purchase by 36 months post-sale. These numbers are both impressive and give the company more predictability than the average retailer. Today, nearly 70% of KITS revenue comes from repeat customers, providing the perfect segway to sell eyeglasses, which is a segment of KITS business growing +40% per year.

COO Joe Thompson explains this logic in more detail:

“One of the tricks of the industry is that you have to start with the manufacturing,” Thompson tells me at the company’s downtown offices before we make the journey east to the warehouse. “It’s counterintuitive, because you’d like to learn how to sell 100 or 1,000 pairs of glasses before investing millions in a lab. The problem is that if you do it that way, you’ve built a marketing or retail organization, and the profit is in the lens. Before we sold our first pair of glasses, we put a couple million into the first version of our lab.”

This is a model that reinforces itself. Although KITS gross margins lag below peers such as Essilor (65%) and Warby Parker (54%), the model requires much lower fulfillment and G&A expenses (30% SG&A margins for KITS versus 58% for WRBY). These costs then get passed back to the customer in the form of low prices, while for every purchase made, KITS gets more data about styles, purchase behavior, and word of mouth spreads via a great experience. This explains how KITS can sell high-quality products at disruptively low prices while maintaining profitability.

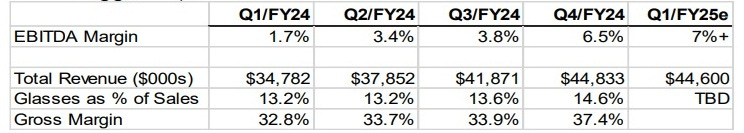

As mentioned, this is a structural moat that would be difficult to breach as it would require a complete overhaul of competitors’ cost structure and operating footprint along with a willingness to accept lower prices. An illustrative example is digital progressives, where buying from KITS means customers are paying less than $100, versus $800-1000 industrywide. As Kits Eyecare expands its production scale, it anticipates further operational leverage and increased profitability. Glasses currently make up 14% of revenues, and further increases will boost margins significantly.

Importantly, KITS has avoided traditional e-commerce marketing channels, choosing to sidestep high-cost Google and Instagram ads in favor of local influencer traffic. KITS has relied heavily on the freemium model along with first-time purchase discounts, knowing they will entice customers to return, driving a high LTV over the next few years. Future growth will come from KITS ‘Own this city’ campaigns, where KITS will enter into a favorable geography where they’ve seen strong purchase behavior, hand out free glasses, build relationships with micro influencers and set up pop-up shops for 3-4 months. These campaigns have been wildly successful in driving new and recurring purchase behavior. Despite the momentum, KITS focus on costs means marketing spend won’t exceed 15% of revenues from here.

Industry / Competition

The US optical industry is a $70B, recession resistant space which has exhibited consistent stable growth across most economic cycles. Importantly, the industry is ripe for disruption, as greater than 50% of the industry still trades between mom-and-pop shops, who are experiencing the most significant migration to online platforms, mirroring trends in other industries.

Since 2005, online penetration for contacts has grown from 5% to 40%, while sales of eyeglasses grew from 1% to 18%. This shift accelerated rapidly post-COVID, as the online mix for glasses was 6-8% pre-pandemic, while 15% of contacts purchases were made online pre-COVID. Given global growth in myopia (estimates call for 50% of the global population affected by 2050), further online penetration, younger consumer trends and increasing brand awareness, KITS has an enormous runway for growth.

CEO Roger Hardy speaks more to the competition and industry landscape:

“For many in the industry as this category moves online at an increasing level, it's a challenge if you have a big network of brick-and-mortar overhead. And it's a challenge if you outsource design and manufacturing or have a big head office. And so for us, our heads are down. We're focused on providing category-leading value and greater selection every quarter and the highest quality with delivering in 1 to 2 days. And as we do, we find it's just -- it's more and more difficult for the legacy industry to compete with that. And that definitely has been what we've seen play out so far in 2024."

"Our value proposition is cutting through the noise. And so that's why we see -- I think that's why we see a more efficient yield on our marketing spend. I think that others if their offering is weaker [less value offered] will have to spend more. And over time, they'll be inclined to spend less or not really compete with us. And so I think that's kind of what we've seen.”

I won’t lengthen this writeup with more discussion about Warby Parker as I’ve mentioned them in several places, and although Warby isn’t a perfect comparison, it’s the largest publicly traded eyecare retailer in the space. Most pure play e-commerce businesses (Eyebuydirect, GlassesUSA etc.) either primarily source cheap goods or are not profitable.

Management

Management is punching well above their weight for a company of this size. I won’t rehash the above comments regarding Coastal as I spent a decent amount of time on management already, but again, this is their second act, and they are executing tremendously well. The Board is very qualified. With 70% insider ownership, we are very aligned with the group steering the ship. Compensation is fair with no egregious incentive structures. We’ve spent a lot of time with management and have been very impressed while channel checks have also come back as positive. After HBS, COO Joe Thompson worked at P&G for 14 years and then spent five years at Amazon as the GM of US Retail. He has been the primary point of communication for investors and is very qualified.

Importantly, KITS has built a strong corporate and financial culture. They have a very strong focus on costs on the manufacturing side and have been very disciplined on marketing spend. They treat equity like it’s their own and are mindful of balance sheet flexibility. Wanting to delight the customer is an intangible that will continue to drive strong results via a high value proposition.

Valuation

KITS trades for 2.0x sales and 26x my estimate for FY25 EBITDA. Although not headline cheap, unit economics for eyeglasses are phenomenal. I estimate that KITS has industry-leading CAC/LTV, by acquiring a customer for around $25 who then goes on to spend an incremental hundreds of dollars on KITS.com within 36 months. Additionally, there are opportunities to improve on nearly every line item of the P&L, and this model should show strong operating leverage over time. Despite ten straight quarters of 25%+ revenue growth, KITS fulfillment costs, G&A, and sales and marketing have all trended downward as a percentage of revenue. Furthermore, this is not a post-COVID explosion in the category, as much of this growth is from incremental spending from repeat customers, while new customer growth has been modest at 7-8% per year. Therefore, I don’t believe KITS is experiencing abnormal growth trends.

KITS Q1 2025 results revealed one of the best quarters if not the best quarter in company history. Among the highlights:

10th consecutive quarter of 25%+ growth

6th consecutive quarter of 32%+ growth

Record gross margins

Record EBITDA dollars and record margins

Record new customer growth

Significant increase in AOV

Glasses revenue grew nearly 50% with shipments at 40% growth

Headline guidance for Q2 consisting of lower EBITDA margins is misleading. As a result of strong return on marketing spend, they are pushing the gas on marketing which will have the effect of lowering EBITDA margins sequentially, which made the outlook appear soft. There was some confusion from one analyst on the call. However, this is intentional. Marketing spend is within KITS control and is a lever they can pull up or down as they see fit. Retention metrics and repeat spending reflect they are acquiring a very high value customer, so the right move is to keep doing that. Marketing spend will still remain below 15% of revenues and the rest of this year should show very strong profitability with increased glasses contribution.

As mentioned, a decade ago, Coastal was sold for CAD $430mm. KITS market cap is lower than that deal price, despite knocking on the door of similar revenue profile (for FY25) and similar glasses contribution. Coastal was growing low double digits at the time of the sale, while KITS is in the 30% or above range. KITS is self-funding and a better business. In addition, the assets are worth significantly more today due to inflation and the online eyewear market value has only increased over that time. Penetration is up, and a fast growing, low price, vertically integrated pure play e-commerce business is an excellent way to benefit from this shift.

Over time, KITS can take share by following a repeatable and effective playbook. Management believes the business can scale to CAD $250mm in revenues within 2 years, up from CAD $159mm at the end of 2024. Within five years, KITS is aiming for CAD $500mm in sales, at which point 10-15% EBITDA margins are within reach, conservatively. At that scale, assuming the low-end margin range and significant multiple compression to 15x, KITS stock offers +85% upside. Importantly, management’s targets are not formal guidance, and in my view are conservative given glasses segment growth of 40-50% with no increases in marketing spend. Despite their progress, KITS brand awareness remains low, which provides further room for upside.

At an average growth rate of 24% through 2030 and little change in gross margins, KITS can do $208mm in gross profit. With limited operating leverage, $60-65mm in EBITDA is possible. At 15x the lower end of that EBITDA range, KITS stock offers +110% upside. If KITS continues to grow at 30-35% for the next few years and EBITDA margins expand to 15%, at 15x KITS stock would nearly triple. With a net cash balance sheet, positive cash flow and excellent management, I think downside is limited and intrinsic value is much higher.

Should I be wrong about my assumptions, I trust management, as owners, to steer the business in the right direction. An unprofitable, slower-growing Coastal was sold for 2x revenues in 2014, and I believe it’s only a matter of time before KITS receives some offers from a larger optical industry player.

Risks

The emergence of smart glasses

Growth slows considerably among glasses

Mix shift doesn’t materialize

Operating leverage doesn’t materialize

Investment in new equipment / optical labs as larger than forecasted

Adore this idea, thanks for sharing!

Surely competition isn’t so light? That’ll be my main research focus on this name.

I happen to be in the market for a new pair of prescription sunglasses… I’ll take a look at kits.com and report back 😎

Have you looked at Fielmann as a comp? Not mentioned in your assessment of the US landscape but is a German-listed, majority family-owned vertically integrated player building out in the US.