“So it's sort of a tale of 2 cities. It's a bad time for the business outlook. Actually, collectively for all 3 of our commodities together, I would say that with the exception of COVID, this is the worst collective business outlook we've had in my almost 10-year tenure here at NRP. But it's certainly the best outlook from the standpoint of an equity holder that we've had in the almost 10 years that I've been at NRP.”

- NRP President and COO Craig Nunez, Q3 2024

I shared the following writeup in the Greystone Capital Q4 2024 letter to clients, and I wanted to re-profile it here as an individual idea. I’ve added some commentary along with some resources toward the end of this post.

I’ve received a lot of inbound interest since sharing the writeup, and rightfully so. NRP is a very intriguing setup that I believe has something for everyone; hated industry, significant durability, cash flow generative, large margin of safety and a built-in catalyst for strong base case returns. With no pure public market comp, and a Limited Partnership tax structure means until recently, NRP has been left for dead by public markets (Although I wish I started working on it years ago)!

If you want to get further up to speed, there are plenty of excellent publicly available writeups on NRP and the coal industry, listed below. I first read of NRP on Base Hit Investing, where John’s Huber’s excellent writeup forced me to dig in further.

Although not an owner of NRP units currently, Mohnish Pabrai also presented at Manual of Ideas (paywall) a few weeks ago talking about the mental models behind his investments in coal. Pabrai has chosen to own the producers, which also represent excellent value. I’ll be focusing on NRP, but highlighting his presentation as I think it adequately summarizes why opportunities are available in the coal industry.

During Q2 last year, we started accumulating units of Natural Resource Partners, a coal royalty business with significant durability, ample free cash flow, excellent management, and a cheap valuation. Both the business and investment thesis are simple, resting on two pillars for value creation: debt paydown and increased distributions.

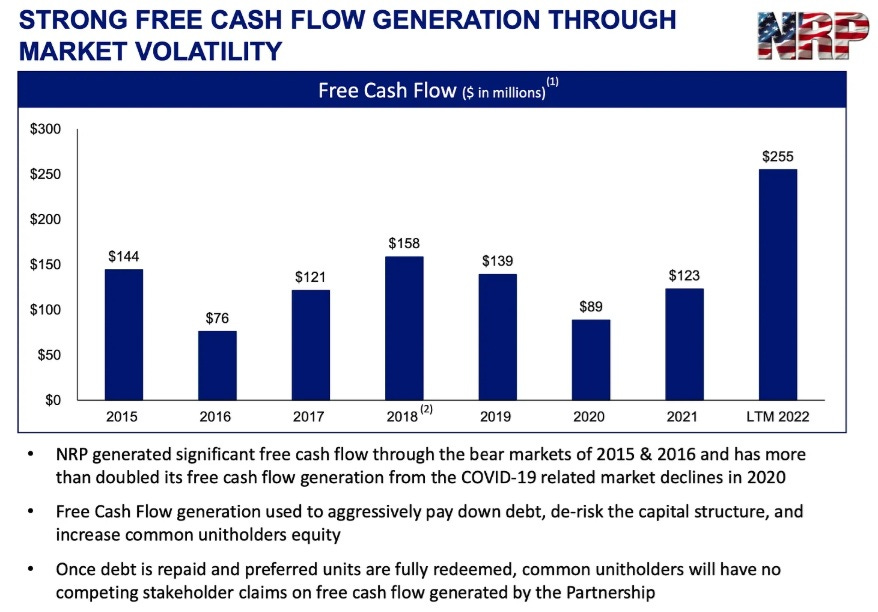

This is one of my favorite slides from NRP’s investor presentation, highlighting exactly what I want to see from a management team:

This is a great place to start when trying to attract the right shareholders, and despite a rocky past few years, I believe intrinsic value will be maximized moving forward, making the current opportunity set very attractive.

The Business

NRP is a royalty business. The company owns mineral rights on 13 million acres of land in various parts of the US, with coal as the underlying commodity on a large portion of this land. NRP leases its properties to coal miners, including some of the largest and lowest cost producers in the world, for a royalty based on a percentage of the price per ton of coal mined. NRP’s leases range from 5-40 years in length and have built in minimum payments owed, regardless of volume mined. NRP also owns a 49% stake in a large soda ash business called Sisecam Wyoming, discussed more below.

Lessees mine two types of coal from NRP’s properties, Thermal coal and Metallurgical or ‘Met’ coal. Thermal coal is a key commodity used for electricity generation, and metallurgical coal is a key commodity used in the production of steel. Currently, NRP revenues are split 70/30 between metallurgical coal and thermal coal, with met coal being the more favorably priced commodity, with a much longer runway for royalty revenue.

In the coal industry, as with most commodity markets, producers (i.e. miners) rarely possess wide moats or differentiation. The price of coal is set by the market, and fluctuates depending on many factors, positively or negatively impacting producer’s revenues and cash flow. As a result, the lower each company sits on the cost curve, the more effectively they can compete (greater profits, lower breakeven point). I have no interest in the producer business model, where nasty operating leverage can wipe out near-term profitability, something past boom and bust cycles have demonstrated.

The royalty business model, however, one of the best business models in the world, provides NRP with unique advantages, including a favorable cost structure leading to durability and resilience, as demonstrated during the past two decades. NRP’s lessees shoulder all the expense of mining the coal, maintaining the properties, and paying the workforce, so NRP benefits from higher volumes and revenues when coal prices are high, and bears none of the operating expense burden when prices are low. This low-cost structure, with no ongoing opex (excluding some corporate costs) or capital investments, a staple of royalty businesses, allows NRP to generate 90% free cash flow margins. A quick detour through the past two decades of operating results would reveal zero years of negative free cash flow through a multitude of coal price environments. With 30-40 years of reserves in the ground, I’m envisioning a long runway for continued cash flow generation.

Reasons for Mispricing

I initially found it hard to believe that a business with the above characteristics was available to be purchased between 4-6x normalized free cash flow. However, there are a few reasons for the discounted valuation, including NRP’s industry affiliation, tax status and recent history, all of which distract from the positive long-term economic picture.

First, NRP is in the coal industry, a discarded sector due to political opposition and anti-ESG sentiment. Given the strong ties between coal and carbon emissions, there is near zero capital being invested into the industry directly (at the company level), and most fund managers are to avoid coal investments like the plague. As a result, company valuations are incredibly cheap, and the current narrative is one of coal’s near-term future in question. Although the use of thermal coal is being phased out in the US and has gone from nearly half of all electricity generation a few decades ago to below 20% today, it remains very much in demand in other parts of the world. In fact, global coal consumption reached a record high of 8.7 billion tons during 2024. Demand for both met and thermal coal is expected to increase moving forward due to rising global electricity demand, high natural gas prices and growing global economies.

The second reason for the discount is related to NRP’s corporate tax structure. NRP is a Master Limited Partnership, or MLP. MLPs have a unique tax structure whereby income is not taxed at the corporate level. MLPs pass their profits directly to unitholders in the form of periodic distributions, which are tax deferred until the sale of the units. This arrangement avoids the double taxation of corporate income and dividends affecting traditional businesses, and in theory should deliver more money to unitholders. The downside is the issuance of K-1s and the perceived tax complexity.

MLPs are not where I’d start my search for an attractive investment. Often sold as vehicles for passive income, corporate governance concerns, low business quality and bond-like correlation to interest rates means that if you find yourself on the receiving end of a mid-stream pipeline MLP pitch, I’d encourage you to run in the opposite direction. However, NRP is unique in that they are massively profitable, business quality is high, and they have a large, stable customer base serving an undersupplied market. Most importantly, corporate governance has been excellent, and we are invested alongside an owner/operator in Chairman and CEO Corbin Robertson. This is not your typical MLP.

NRPs history, however, contains some mishaps, likely the third reason for the discounted valuation, and the context for the quote at the beginning of this appendix.

To reiterate, the beauty of a royalty business lies in its cost structure, or lack thereof. One should not enter the royalty business for excitement. When I visit NRP management at their headquarters next month, I’m half hoping to show up to an empty office. Throughout the life of this business, management would have been best served distributing all NRP’s cashflow to unitholders and spending the rest of the day playing Solitaire. However, as Pascal tends to remind us: ‘all of humanity's problems stem from man's inability to sit quietly in a room alone.’

Leading up to 2016, NRP’s former CEO went on an acquisition spree, purchasing a number of sub-par assets to diversify the business into oil and gas, aggregates and other non-core minerals. These acquisitions had the effect of bloating the asset base without contributing to profitability, and worse, NRP took on a large amount of debt to finance the deals. In 2016, when coal prices plummeted, NRP found itself levered nearly 6.0x, unable to repay their debt, and nearly filed for bankruptcy. The company was bailed out by various third-party lenders and was forced to issue some punitive preferred stock and warrants in exchange for debt refinancing.

The former CEO was removed, and after turning the page on a rough chapter for the business, for the past 8 years, NRP has been manically focused on reducing outstanding debt. The preferred stock and warrants have been eliminated, and depending on free cash flow assumptions, NRP has around 1-1.5 years of term debt remaining on the balance sheet, after which point they will distribute the entirety of free cash flow to unitholders. This is significant for two reasons. One, further debt paydown will have the effect of increasing equity value to unitholders by reducing competing claims on the company’s cash flow. Second, if coal prices decline, unlevered free cash flow will actually increase, given the absence of interest payments. This change in capital allocation strategy has been telegraphed for years (to little fanfare) and will result in a substantial return to unitholders, whereby NRP can return their entire market cap in cash within 5-7 years, giving us a cheap or free option on what it earns after that.

Valuation

The biggest challenge when valuing a company like NRP is the price of coal, which is impossible to predict (and I won’t mislead you with my attempt). My shrewd analysis is that the price has fluctuated wildly in the past and will do so in the future. Although thermal coal consumption should decline, in particular, as renewable energy usage increases, so too will supply. Existing mines have limited capacity (albeit, decades) and there remains a lack of investment industry wide given coal’s anti-ESG status. Dwindling supply, along with elevated costs for producers should help create a floor for both met and thermal pricing. I could be wrong.

An easier challenge is predicting how much cash NRP should generate under different coal price scenarios, where precision isn’t required to do well. Using coal price forecasts (taken with a grain of salt) through 2028 that range between $180/mt and $230/mt for various types of met coal, I estimate NRP can generate between $14-18 of free cash flow per share, for a 15-20% yield on our cost basis. This would represent between 50-65% of its current market cap during the next four years.

I view these estimates as conservative considering where most producers sit on the global cost curve, along with minimal upward projections in revenue per ton for NRP. The more accurate estimates might come from examining NRP’s 10-year and 20-year average free cash flow figures (capturing a multitude of pricing environments), which reflect average free cash flow of $20/share, or a 22% yield based on our cost basis. NRP will finish the year close to this average, having generated $185mm in FCF ($14/share) through Q3 of 2024, despite the unfavorable business outlook.

Boosting my confidence is management, who have shown themselves to be rational and thoughtful capital allocators, doing the obvious things to create value. Debt paydown and increasing distributions are the obvious things. Management owns 30% of the business and would benefit both from a higher distribution along with repurchasing units, which they’ve also talked about.

Source of Optionality

Lastly, there are two very interesting and potentially substantial sources of optionality worth discussing. First, as mentioned, NRP owns a 49% stake in the world’s leading low-cost provider of natural soda ash, Sisecam Wyoming. Soda ash is a key commodity in the manufacturing of glass, along with products like soaps and detergents. Demand for soda ash is expected to grow around 4% during the next decade in line with growth in global construction and auto manufacturing, currently in cyclical downturns. Sisecam Wyoming is located in the Green River Basin in Wyoming, which holds the largest and one of the highest purity deposits of trona ore (key input in soda ash) in the world. Sisecam has annual production capacity of 2.5mm tons, with proven and probable reserves of greater than 50 years.

Historically, NRP’s soda ash royalties were between $25-40mm annually. However, soda ash pricing has reached a decade low, driven by Chinese oversupply and global construction softness, impacting current distributions. Although distributions from Sisecam are likely to remain depressed for the next few years, there is value here that should be factored into the valuation eventually. Furthermore, Sisecam, formerly part of a publicly traded business, was purchased in part, by its owner during 2023, marking to market NRP’s 49% stake at around $500mm, or 35% of the current market cap. I don’t view it as likely, but it’s possible NRP could monetize their stake at some point, leading to additional upside.

The second source of optionality comes in the form of carbon capture utilization and storage initiatives. For the uninitiated, carbon capture is the process of trapping the carbon dioxide that is produced by burning fossil fuels and storing it underground, or in a way that eliminates exposure to the atmosphere. The industry is in its infancy, but large amounts of capital have been raised in the past few years with consulting firm Wood Mackenzie estimating the industry may attract $150 billion in global investments this decade. Some of that capital has flowed and will flow to the massive and capital-intensive technology of Direct Air Capture.

I’m certainly not the authority on direct air capture technology, but what I can tell you is that direct air capture facilities are massive. As a result, to capture and store carbon successfully, you need two things: plenty of contiguous acreage, and sequestration (storage) rights. NRPs 13 million acres of land ownership includes both. NRP is uniquely positioned for carbon sequestration because it owns large contiguous tracts of land with the full ownership of storage rights. While only a few million of that acreage will prove acceptable for carbon capture, the land will prove valuable to larger oil and gas businesses as time goes by. To illustrate, NRP has already entered into two long-term agreements with Occidental Petroleum and a subsidiary of Exxon Mobil for construction rights to build DAC facilities on NRP properties in exchange for cash payments to NRP. Like the royalty business, NRP bears no upfront or ongoing costs for these construction projects, simply collecting a royalty on metric tons of carbon captured.

Early details surrounding the potential scope of the projects are publicly available, with Occidental outlining the potential for 20 DAC facilities to be built on the 65k acres they lease from NRP. Each facility could be responsible for capturing 1 million metric tons of carbon per year. NRPs estimates $1-2 dollars per metric ton as a royalty, which would equate to $20-40mm in free cash flow, with no upfront cost or capital expense on the part of NRP. Keep in mind, this is just 65k acres of land, compared to millions of acres suitable for carbon capture. To manage expectations, any meaningful carbon capture optionality (if it materializes at all) is likely 5-10 years away, but it doesn’t make it any less significant and would also provide further upside over time.

Without underwriting any meaningful soda ash distributions nor any contribution from carbon capture initiatives, we are still left with a quality mineral rights business, abundant free cash flow, a built-in return stream and tremendous durability. I like our odds. Researching NRP reminded me of our prior investments in SPACs, some of which ended up compounding at very high rates of return. Behind any strong stigma toward a particular asset class are opportunities to find value.

Further Reading:

https://www.amazon.com/Coal-Human-History-Barbara-Freese/dp/0099478846/ref=tmm_pap_swatch_0

Adam Wilk is the Founder and Portfolio Manager of Greystone Capital Management LLC, a small cap focused investment firm.

Adam can be reached at adam@greystonevalue.com

Disclaimer: Adam Wilk and clients of Greystone Capital Management own units of NRP, The purpose of this post is for informational and educational purposes only and should not be construed as a recommendation to purchase or sell any security. Do your own due diligence and seek counsel from a registered investment advisor before trading in any security mentioned.

Thanks for sharing all the resources at the end!

Hello there,

Huge Respect for your work!

New here. No readers Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing poetic take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

Built to Be Left.

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e