Back in January, I wrote that I’d like to start writing more idea related posts. Well, here we are in May and I’m finally getting around to another idea update. A concentrated portfolio + research and portfolio management priorities don’t lend themselves to frequent posts. However, Q1 earnings season is off to a strong start, with multiple companies in our portfolio reporting record results.

This is not investment advice, DYODD and please see the disclaimer at the end of this post.

Franklin Covey (FC)

I sold our position in Franklin Covey for reasons outlined in my Q1 letter to clients, but I’ve also been thinking about AI related risks across the portfolio, and business risks associated with teaching, coaching and research based businesses. I’ve held the view that, among other things, part of Franklin Covey’s moat lay in their content catalog, curated over decades, tailoring the best learning and effectiveness solutions for individuals and businesses alike. With more customers, more feedback and data can be gathered about what works, leading to creating better, more tailored solutions for customers, leading to more content, leading to more customers etc… Today however, I wonder if AI can wedge itself in between an organization and a paid offering like FC’s All Access Pass, rendering the platform less valuable over time. I’ve experimented with ChatGPT in building curriculums for subjects I’d like to learn more about or improve my knowledge base, and AI is incredible for such things. I’d imagine they can do the same for ongoing leadership and business effectiveness solutions over time.

I think FC’s multi-year contracts help mitigate some of this risk, but historically we’ve seen the service attachment rate decline during periods of economic uncertainty. It’s possible businesses start to look elsewhere. With the power and effectiveness of AI growing exponentially, maybe organizations dedicate resources to using more of these tools to advance their effectiveness and leadership needs.

I think there will always be a place for a business like Franklin Covey, they can use AI to augment their technology, and they won’t be disintermediated overnight, but technological disruption is a long-term worry I have about the business.

Natural Resource Partners (NRP)

During FY24, Natural Resource Partners generated $250mm in free cash flow, despite met and thermal coal prices significantly lower than those of the past few years. This is the beauty of the royalty business model, with no ongoing capital requirements and minimal operating expenses. To be clear, free cash flow generated during 2025 will be lower than 2024, but within the next year or so, NRP will have the flexibility to both repurchase units and significantly increase their distributions to unitholders, which I estimate will amount to a 15-20% yield on the current price.

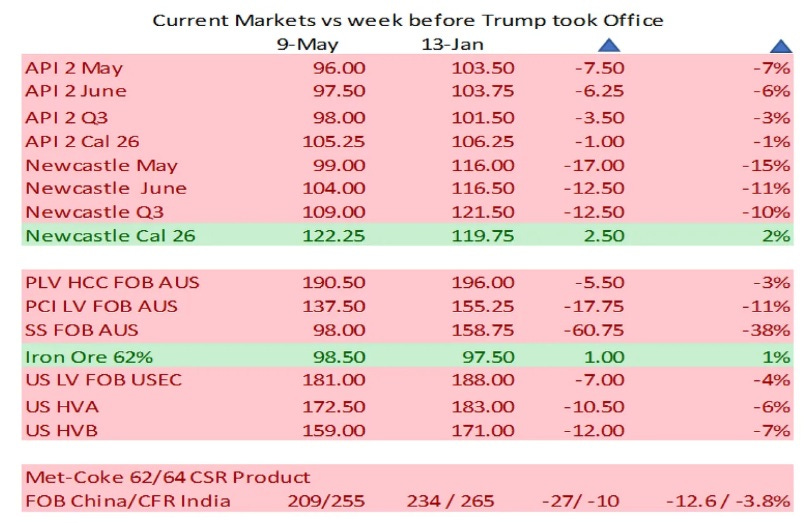

During Q1 2025, revenues for NRP declined -21%, and free cash flow declined by -50% on the back of lower coal royalty revenues per ton. As mentioned, this is to be expected in the near term given the state of the industry, including trough Chinese demand for met coal. The longer term trend to bet on will be industry-wide underinvestment, the primary driver of pricing from here (with the occasional natural disaster / accident thrown in for good measure).

Running some prior sensitivity tests for various met coal pricing revealed that at AUS PLV prices of $190/Mt, NRP should be able to generate around $150mm of FCF assuming volumes remain relatively stable (obviously subject to change with volumes/royalty rates). That’s about where we are now, which the coal sources I use to track the industry are calling ‘life support’. I’d expect to see more production cuts, layoffs, weak earnings reports and bankruptcies as we move through the year. Interestingly, year to date coal production is 4.0% higher than the same period last year, somewhat of a silver lining.

NRP has the cost structure and balance sheet to withstand a prolonged downturn. I estimate they are 12 months of cash flow away from a net cash balance sheet. Despite current met coal prices, cash flow remains robust. Annualizing NRP’s Q1 free cash flow of $35mm gets us to $140mm, or around an 11% yield on today’s price. With continued debt paydown and increased distributions within the next 12 months or so (with optionality on higher met coal prices) I like our odds to do well owning NRP over a long period of time.

Medical Facilities Corp. (MFCSF)

The start of 2025 has been more of the same for Medical Facilities Corp. The company is operating their hospitals profitably, generating tons of cash and returning it to shareholders. During the quarter, through their substantial issuer bid, MFC repurchased nearly 15% of shares outstanding for a price of CAD $18/share. The current price is CAD $15.5/share. I use CEO.CA to track the company’s share repurchases, and you can see MFC gobbling up more shares during Q2 as well, with another 1.5% retired QTD, by my count.

In Q1, MFC generated $6.3mm in distributable cash flow, compared to $6.5mm during Q1 last year. Q2 and Q4 are typically very strong quarters, and if MFC generates cash flows similar to last year, a 12% FCF yield on today’s enterprise value is quite attractive. Continued share repurchases will be accretive. I’d assume that the company will continue to entertain acquisition offers for their assets, but even in the event Black Hills was a one-off deal that was too good to pass up, I'm happy with a durable mid-teens yield on today’s price and a management team who is allocating capital for the benefit of minority shareholders. I still peg intrinsic value around CAD $25/share.

Leon’s Furniture (LNF.TO)

Leon’s reported stellar Q1 results despite a tough industry backdrop and once again outperformed the broader market. Leon’s has been an bright spot within the furniture industry and as forecasted in line with their operating history, is holding up well in this environment.

Leon’s reported a +5.2% year-over-year increase in furniture sales for Q1, contributing to record revenue of CAD $579.5 million, up 3.1% from the previous year. Industry sales were flat to down slightly, reflecting further market share gains for Leon’s on the back of improved inventory availability. There were some orders fulfilled in the quarter that were delayed from Q4, contributing to the revenue increase, but same store sales growth came in at +3%, the first growth quarter since Q2 2024. Gross margins were up above 44%, as one of Leon’s strengths is their ability to source inventory and save on supply chain costs. Earnings were up significantly and EBITDA margins also expanded by 100 bps.

For Leon’s Furniture, only a small portion of their business will be directly affected by tariffs. As a Canadian based retailer, Leon’s sources goods from countries outside of the US but does derive a small portion of revenues from the US (sub-10%). In addition, they are the largest importer in the country of containers from China, giving them tremendous negotiating leverage and the ability to weather any supply chain storms, as evidenced by their margin profile during and post-COVID when container rates skyrocketed by 5x. This is not a luxury their competitors have, and I would expect Leon’s to take incremental market share in an adverse economic scenario, with the window for M&A also opening. Despite Leon’s strong performance through all cycles, I believe shares remain priced as if bad news is on the horizon. I peg intrinsic value at CAD $50-60/share versus today’s price of CAD $25/share.

Limbach Holdings (LMB)

Limbach reported record Q1 results across their business, continuing the trend of incredible execution as the business shifts from construction focused to one focused on recurring building services.

The results speak for themselves.

Total revenue was $133.1 million, an increase of 11.9% from $119.0 million.

Record quarterly net income of $10.2 million, or $0.85 per diluted share

Adjusted EBITDA of $14.9 million, up 26.5% from $11.8 million.

Owner Direct Relationships (“ODR”) revenue increased 21.7%, or $16.1 million, to $90.4 million, or 67.9% of total revenue.

Total gross profit was $36.7 million, an increase of 18.1% from $31.1 million.

Limbach is delivering on both the organic and inorganic opportunities in front of them, with a long runway for growth. LMB stock is up nearly 500% during the past two years, but management’s comments sound like they are just getting started.

A few key quotes from the Q1 call really stuck out to me:

“We believe we currently hold only a small share of the total work needed to keep these complex operations running efficiently.”

“Big initiative for 2025 is to transition our strategic customer relationships, from a reactive to a proactive approach with the goal to help influence and co-author customer budgets by the end of the year. This will allow us to strengthen our relationships and create more predictability for our sales pipeline.

In order to achieve this objective, we are focused on collecting data from massive repair history, utility bills and facility assessments, which we can analyze and present back [indiscernible] solutions to our customers.”

“…the opportunity to collect and analyze this data at scale represents a major inflection point for our business. As our data set grows, so does their ability to surface patterns, benchmark performance and identify opportunities that would otherwise remain hidden. This capability not only positions us as a more strategic partner to our customers but also has the potential to create a powerful competitive advantage that compounds over time.”

“We strive to become preferred home for outstanding family-owned and operated businesses.

In recent months, we've seen evidence that our approach is delivering results and believe that we're developing and assessing opportunities that are unavailable to other potential buyers.”

There appears to be a massive opportunity for Limbach to both continue it’s organic mix shift toward additional ODR services, while becoming even more entrenched within their customer base (leading to larger and more predictable future opportunities), and using cash flow to accretively buy smaller service businesses at low to mid single digit multiples. Since 2022, this story keeps getting better and better. Shares are up 20% since reporting Q1 results, and LMB trades at around 22x FCF, but if ODR revenues continue to grow 20%+ and EBITDA margins keep increasing, today’s price will look cheap.

Within 4-5 years LMB could be doing close to $1B in revenues and 15% EBITDA margins. That’s 9.5x EBITDA at today’s price.

KITS Eyecare (KITS)

I introduced KITS as a new position in our Q1 2025 letter, which was followed up by KITS reporting one of the best quarters, if not the best quarter in company history.

Among the highlights:

10th consecutive quarter of 25%+ growth

6th consecutive quarter of 32%+ growth

Record gross margins

Record EBITDA dollars and record margins

Record new customer growth

Significant increase in AOV

Glasses revenue grew nearly 50% with shipments at 40% growth

The bottom line: KITS is executing incredibly well. As a result of strong returns on recent marketing spend, they are pushing the gas on marketing during Q2 which will have the effect of lowering EBITDA margins sequentially, making the headline outlook given during Q1 look soft. However this is intentional and within KITS control to pull on marketing levers as they see fit. Customer retention metrics and repeat spend have revealed they are acquiring a very high value customer, so the right move is to keep doing that. But marketing spend will still remain below 15% of revenues so the rest of this year should show very strong profitability with increased glasses contribution.

On that note, based on Q1, the outlook for Q2, and because increased marketing spend has been leading to growth, KITS is setting themselves up to exceed revenue estimates. Consensus for 2025 is $201mm (up from $197mm yesterday). I have them doing somewhere between $207-211mm.

As called out by an analyst on the Q1 call, KITS now looks eerily similar to Coastal Contacts (the first business founded by KITS Chairman and CEO Roger Hardy) at the time it was sold. Coastal was doing $200mm revenues in 2014, which KITS will surpass this year. It’s interesting to note that Coastal grew their top line 24% for 10 years and during that time gross margins expanded from 18% to 42% as glasses became a larger part of the mix. Gross margin expansion for Coastal took off significantly once they hit $150mm in revenues. It took Coastal 8 years to surpass 40% GMs, while KITS should get there in year 5-6 (management’s goal is 40% near term on the way to 45%).

This is at least illustrative of the significant opportunity for KITS during the next 4-5 years. Similar to Limbach, I can’t help thinking about the potential for this business to become a long-term compounder. You have a great combination of growth, a huge industry, a small company in the early stages of their opportunity, a high customer value prop, organic and inorganic opportunities, a management team that thinks long-term, a recurring revenue business model, low brand awareness, a shifting industry landscape, high ROIC on normalized margins, no dilution risk and a fair starting valuation. There is also a great mix-shift story taking place as higher margin eyeglass sales become a larger part of the business. I’m happy to be along for the ride.

I spent some time with COO Joe Thompson in March, which was recorded and distributed via the Business Breakdowns series on Microcapclub. The interview is available below.

Adam Wilk is the Founder and Portfolio Manager of Greystone Capital Management LLC, a small cap focused investment firm.

Adam can be reached at adam@greystonevalue.com

Disclaimer: Adam Wilk and clients of Greystone Capital Management own shares of NRP, LNF.TO, DR.TO, LMB, and KITS.TO. The purpose of this post is for informational and educational purposes only and should not be construed as a recommendation to purchase or sell any security. Do your own due diligence and seek counsel from a registered investment advisor before trading in any security mentioned.

Thank you. It would be nice if NRP decides to convert to a regular corporation. As a non US resident, we are subject to high taxes, both on dividends (37%+10%) and trading (10% on the selling proceeds). It's insane...

I haven't read the 10k yet, do you know if they have any plans?

Interesting companies.

FC has been around in the microcap space since 2017! I remember read about the company back in that year.

Leon's Furniture: What makes the company different to other furniture companies?